AEPS OFFUS ISSUER WD TXN Meaning - RetailUnity

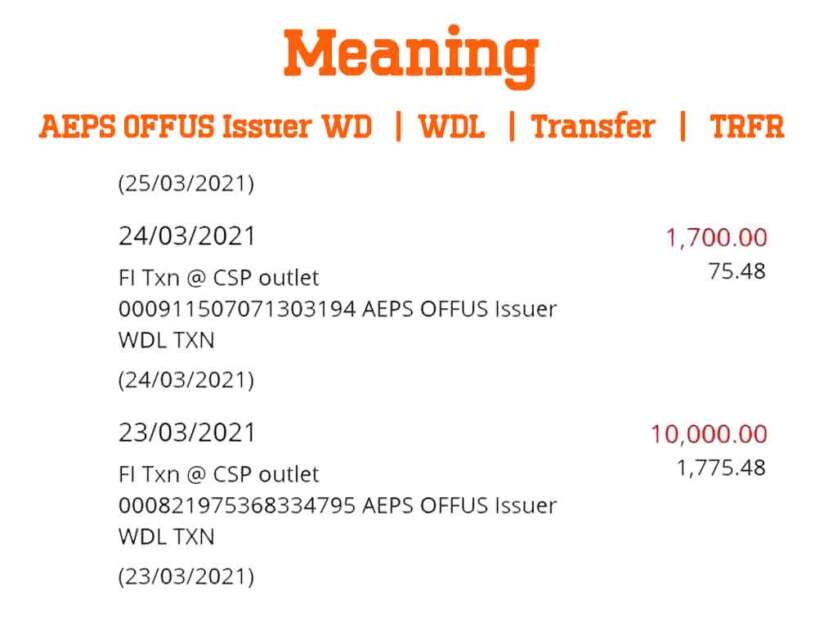

In banking transactions, particularly for retail AePS agents and bank customers, the cryptic message “AEPS OFFUS ISSUER WD TXN” might have popped up on your screen, leaving you puzzled about its meaning. In this article, we decode the statement “AEPS OFFUS ISSUER WD TXN” and shed light on its significance in the banking sector.

You might have come across this statement (AEPS Offus issuer WD TXN) on your bank statement. If you suspect that a particular transaction was not authorized by you, it’s important to reach out to your bank and file a complaint regarding the transaction. If you wish to gain a better understanding about this statement, continue reading until the end. To learn more about how to stop cash withdrwal from your bank account using AePS, click here.

First word in the statement is “AEPS”. AEPS stands for “Aadhaar Enabled Payment System,” and it is a secure and convenient method of conducting banking transactions using Aadhaar authentication. Aadhaar is a unique identification number provided by the Indian government (UIDAI) to residents, and it plays a important role in financial inclusion and digital banking in India.

OFFUS, in the context of banking and financial transactions, stands for “Off-Us Transaction.” It refers to a scenario where there is movement of funds from one bank to another, necessitating an interbank settlement. In other words, OFFUS transactions involve interactions between different banks to facilitate financial transfers.

For instance, suppose you are a State Bank of India (SBI) customer. If you conduct an AePS cash withdrawal transaction using the Relipay App (Service Distributor), which offers AePS services of ICICI Bank (Actual Service Provider), your transaction would be classified as an OFF_US Transaction.

ISSUER, in the AEPS OFFUS ISSUER WD acronym, refers to the entity that issues or provides the service. In the context of AEPS, the issuer is typically a bank, financial institution, or any authorized service provider. These issuers are responsible for facilitating transactions, ensuring security, and maintaining the infrastructure required for AEPS services.

In the example provided earlier, the issuer bank is ICICI Bank.

Lastly, WD stands for “Withdrawal Transactions. ” It signifies one of the primary functions of AEPS, allowing users to withdraw cash from their bank accounts using their Aadhaar number for authentication. This feature is particularly beneficial for individuals in remote areas who may not have easy access to traditional bank branches or ATMs.

AEPS OFFUS ISSUER WD, when broken down, signifies the “Aadhaar Enabled Payment System with Off-Us Transactions and Withdrawal Transactions.” In essence, it represents a comprehensive and inclusive approach to banking and payments in India.

The AEPS system allows users to conduct various financial transactions, including balance inquiries, fund transfers, and withdrawals, using Aadhaar authentication. Its inclusion of Off-Us transactions highlights the interbank nature of these financial activities and their impact on the broader banking ecosystem.

AEPS OFFUS ISSUER WD may seem like a complex acronym, but it represents a vital system in the world of banking and digital payments. Understanding its components—AEPS, OFFUS, ISSUER, and WD—provides insight into how it facilitates financial transactions, especially in regions with limited connectivity. As India continues its journey towards financial inclusion and digitization, AEPS OFFUS ISSUER WD remains a key player in making banking services accessible to all.

If you’ve seen “AEPS Offus issuer WD TXN” on your bank statement and suspect an unauthorized transaction, contact your bank to file a complaint. Keep reading for a better understanding. To stop cash withdrawals via AePS, click here.