Flipkart Pay Later KYC Update - KYC Now Mandatory for All Customers

Flipkart Pay Later facility is now available only to users who have completed KYC, which is now mandatory for all customers. If you're currently using Flipkart Pay Later and haven’t completed KYC, you won’t be able to access the service. You must complete online KYC, which takes just 1 minute.

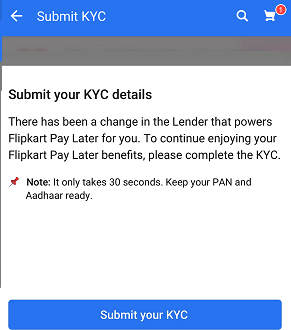

Flipkart says: “There has been a change in the lenders that powers Flipkart Pay Later for you. To continue enjoying your Flipkart Pay Later benefits, please complete the KYC.”

What is Flipkart Pay Later?

Flipkart Pay Later is a digital credit product that allows eligible customers to buy products now and pay for them later. To use this service, customers must complete the Know Your Customer (KYC) process.

The Pay Later limit starts from ₹5000 and increases based on timely repayments.

How to Complete Flipkart Pay Later KYC in 1 Minute

If your KYC has expired or not yet completed, follow the steps below using the Flipkart App:

Step-by-step KYC Process:

- Open the Flipkart app and navigate to the “My Account” section.

- Tap on “Flipkart Pay Later” and then click “Complete your KYC.”

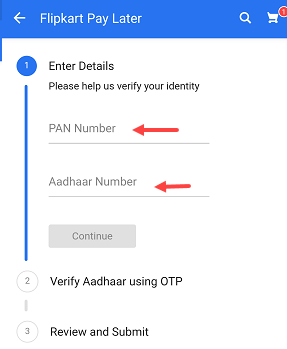

- Enter your PAN Card and Aadhaar card numbers.

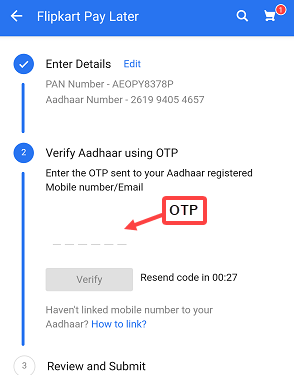

- You will receive an OTP on your Aadhaar-registered mobile number.

- Enter the OTP and click Verify.

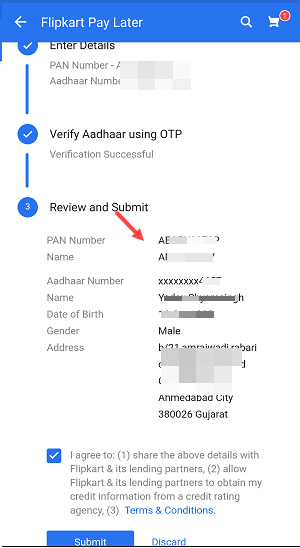

- Review your details and click Submit.

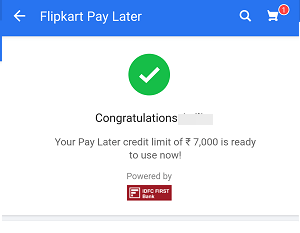

Image Guide to Complete KYC

1. Tap on Submit your KYC

2. Enter PAN and Aadhaar Number

3. Enter OTP sent to Aadhaar-linked mobile

4. Review and Submit

5. KYC Successful – Reactivated Flipkart Pay Later

Important Notes

- Flipkart Pay Later eligibility depends on your credit score, transaction history, and other factors.

- If your KYC is not approved, you’ll need to reapply and resubmit the documents.

Once your KYC is successfully submitted and verified, you can start using Flipkart Pay Later again to enjoy seamless shopping and pay next month.